When you log into your PayPal account, do you see an alert saying that you must give the company your Social Security Number?

Are you having difficulty withdrawing funds because you haven’t given your SSN?

U.S. customers need to provide tax identification to PayPal in some circumstances. This article explains why.

Table of Contents

Why Does PayPal Need Your SSN?

There have been several reasons that PayPal has given for collecting social security numbers.

I’m not implying that these reasons aren’t true! It’s just that they have changed over the past few years.

IRS and tax compliance

The latest reason is the Inland Revenue Service (IRS).

PayPal is required by federal law to report sales transactions over a certain threshold for tax compliance.

If you want to know more about these federal regulations, the reference is Section 650W.

Patriot Act

Back in 2017, customers reported that PayPal staff cited the Patriot Act to explain why their SSN was required.

This could refer to the anti-money laundering clause that requires reporting of financial transactions over 10 thousand dollars.

But it wouldn’t have to be that much/ In theory, any potentially suspicious transaction would require reporting to the authorities. It’s a pretty broad Act.

However, the PayPal documentation now refers to the IRS requirements.

Speculation

Customers have noticed that PayPal sometimes asks for an SSN when it’s not required by federal regulation. Why do they want these extra details?

In my opinion, PayPal would prefer to have an SSN from every user in order to increase buyer confidence in using the site. Why so?

If you know that the company has identifying details for the anonymous person on the other side of a transaction, you may be more likely to use that company!

That’s all very well for the buyers. But it puts small-scale sellers into a position of providing sensitive information to a third party when there is no regulatory need.

I suggest that you don’t provide your SSN if it’s not needed to comply with federal laws.

Who Needs To Provide Their SSN?

If you occasionally use PayPal to make purchases online, you don’t need to provide your SSN to the company.

You may see a form on the website that asks for it, but it is optional if you only use PayPal as a buyer.

In contrast, sellers may be required to provide their SSN. If you sell goods or services using PayPal, then the requirement depends on the amount and frequency of your sales.

Before I address this, let’s look at two other types of identification.

Three types of identification numbers

There are three different identification numbers that PayPal recognizes.

- SSN: social security number

- EIN: employer identification number

- ITIN: tax identification number.

Which identification number should you provide?

If you’re selling goods and services as an individual, you’ll probably use your SSN. Some people don’t have an SSN. They can provide an ITIN instead.

However, a small business may also have an EIN. In that case, this is what you should provide.

Corporations and partnerships must provide an EIN.

Other categories that need an SSN

Sellers aren’t the only the type of PayPal user that needs an SSN.

If you apply for a PayPal debit Mastercard, you will also need to provide your full SSN.

If you apply for PayPal Credit, then you will need to give the last four digits of your SSN.

How Much Sales Trigger A Request For An SSN?

In general, you’ll be asked for an SSN if you meet both of these requirements in a calendar year:

- Your gross sales hit 20 thousand dollars

- Your receive over twenty separate payments

But don’t think that the request only gets triggered at these thresholds. You’ll probably get the request as you approach these levels.

Some customers have also reported getting SSN requests at much lower amounts of sales.

One sixteen-year-old complained on the PayPal forum that he was asked after a $7.50 sale of some art to a relative.

Another adult reported that he sells a few items a year on eBay and was nowhere near 20K. Yet he was required to provide an SSN.

Different regulations

Sometimes the problem is that different states can set their own thresholds at which PayPal is required to report to the tax authorities.

It can be as low as six hundred dollars.

How Will You Know If PayPal Requires Your SSN?

When you log into your PayPal account, you will see an alert stating that your SSN is required.

PayPal also sends you an email. As I mention later in this article, I advise that you don’t click on links in emails from PayPal.

Instead, you should log into your account directly and check that the alert is there.

What Happens If You Don’t Provide Your SSN Or Other Tax Identification?

You will find it very difficult to do business through PayPal if you don’t comply with the request.

You’ll still be able to make purchases if your bank account is linked.

However, your account will be limited in ways that prevent you from removing funds from the platform.

How To Hold A PayPal Balance Without Providing Your SSN

If you want to hold a balance on PayPal, then recent regulations may require you to provide your SSN.

The Consumer Financial Protection Bureau issued regulations in 2019 that prompted PayPal to require further customer identification.

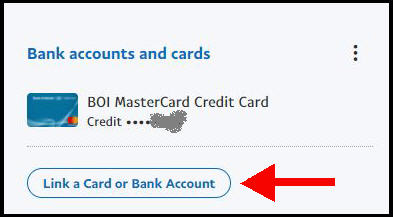

However, there’s a way to hold a balance without giving the extra details. If you link an accepted bank account to your PayPal account, then you don’t need to give your SSN.

Avoid Providing Your SSN By Registering For Business Identification

I mentioned that SSNs aren’t the only identification number that PayPal accepts.

If you’re running a small business, you can also register for an EIN (Employer Identification Number). This can be done online for free.

You can then provide the EIN instead of your personal SSN.

Avoid Providing Your SSN By Switching To A Personal Account

A Personal account on PayPal requires less verification. So, you may want to switch over to a Personal account.

Unfortunately, PayPal doesn’t provide an automatic way to do so via the website.

We’ve got all the details on how to do this in our article on how to downgrade a PayPal Business account to a Personal account.

How Are You Required To Verify Your SSN?

You can either post or upload a copy of an official document that has your SSN.

The easiest way is to take a scan of your social security card. You can also use the letter the IRS sent you assigning you the number.

Otherwise, any of these documents will be enough as long as they are dated within the last 12 months:

- paystub showing your SSN

- tax document signed by a 3rd party preparer

- 1099 form

- W2 issued by your employer

What if you don’t have one of these documents?

Have you lost your social security card? You can apply online for a replacement.

Alternatively, visit your local Social Security Office and ask for a letter that verifies your number.

Why Are Some Users Reluctant To Provide Their SSN?

It’s understandable that some people are reluctant to hand over their SSN.

After all, there are government agencies that warn citizens to be careful about giving it to third parties.

The main concern is that the SSNs will end up in the wrong hands. This could happen if there was a security breach in the company systems.

So, the next question is how safe are PayPal’s systems.

Is It Safe To Give PayPal Your SSN?

PayPal is a massive company that invests millions in its technical and security infrastructure. To date, the company has not suffered a breach of customer data.

It’s possible that it could happen. But the same is true of any other financial organization that has your SSN.

There’s no reason to have more reservations about PayPal than your local bank.

Be careful about how you provide your details

I get a fake phishing email every week that purportedly comes from PayPal.

So, be careful about how you respond to an email requesting your SSN. It could be fake.

Don’t click on any links in the email. Instead, go directly to PayPal.com and log into your account. If PayPal needs your SSN, you will see an alert on the main page.

PayPal Aren’t A Bank! How Can They Require Social Security Numbers?

Some customers point out that Paypal isn’t a bank. They accept that banks must take an SSN when you open an account, but they wonder why PayPal also enforces this requirement in some circumstances.

It’s true that PayPal isn’t a bank. However, because they facilitate financial transactions, they are subject to federal regulations.

They are required by law to report transactions over a given threshold to the IRS.

What About PayPal Users Outside The United States?

I’m a business owner outside the United States, but don’t think that we escape from proving our identity.

As I have sales from U.S. customers and entities, I had to provide documentation that my business was not within the U.S.

My home country is in the European Union, so I’m also required to report on aspects such as Value Added Tax (VAT).

I filled out a separate online form on the PayPal website and uploaded a document with my VAT number.